Renters Insurance in and around Wichita

Your renters insurance search is over, Wichita

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

- Wichita

- Andover

- Bel Aire

- Butler County

- Valley Center

- Sedgwick County

- Towanda

- Park City

- Newton

- Augusta

- Maize

- Derby

- Goddard

- Mulvane

- Rose Hill

- Cheney

- Wellington

- Belle Plaine

- El Dorado

- Garden Plain

- Clearwater

- Kechi

- Benton

- Delano

Insure What You Own While You Lease A Home

Your belongings are important and so is keeping them safe. Doing what you can to keep it safe just makes sense! And one of the most reasonable things you can do is getting renters insurance from State Farm. A State Farm renters insurance policy can cover your possessions, from your clothing to your books. Not sure how much insurance you need? No problem! Shawn Ferestad is ready to help you assess your needs and help secure your belongings today.

Your renters insurance search is over, Wichita

Your belongings say p-lease and thank you to renters insurance

There's No Place Like Home

When renting makes the most sense for you, State Farm can help cover what you do own. State Farm agent Shawn Ferestad can help you with a plan for when the unexpected, like a water leak or an accident, affects your personal belongings.

As one of the industry leaders for insurance, State Farm can offer you coverage for your renters insurance needs in Wichita. Visit agent Shawn Ferestad's office to get started on a renters insurance policy that works for you.

Have More Questions About Renters Insurance?

Call Shawn at (316) 267-8273 or visit our FAQ page.

Simple Insights®

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Is renters insurance required?

Is renters insurance required?

Renters insurance protects more than your belongings in the event of a loss. Learn about what renters insurance covers and how it can help you.

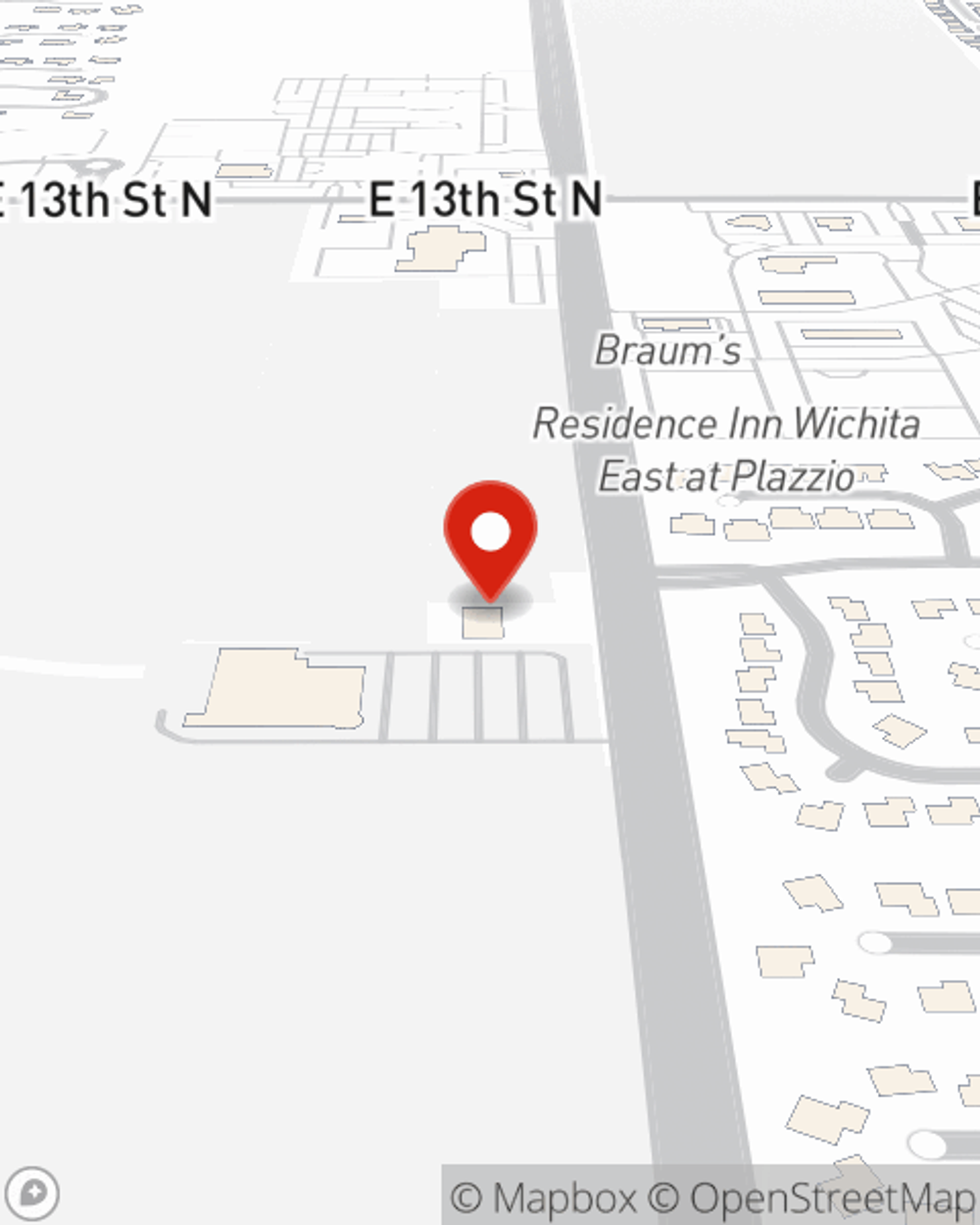

Shawn Ferestad

State Farm® Insurance AgentSimple Insights®

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Is renters insurance required?

Is renters insurance required?

Renters insurance protects more than your belongings in the event of a loss. Learn about what renters insurance covers and how it can help you.